Six Hidden Costs of Production Incentives

The old adage holds true: you've gotta spend money to make money

Imagine this nightmare scenario:

Your production company has a project you’re passionate about. The network shows interest, but the budget’s too high.

But there’s hope: your shoot location offers a production incentive. You check the basic program rules and run a budget to estimate how much you’ll receive.

Good news! The incentive is enough to close the budget gap. The network is happy, and you secure a greenlight. Your production accountant applies for the incentive, receives preliminary approval, and you’re on your way.

Then, costs associated with the incentive begin to creep in, carving into that precious savings you promised the network.

Audit fees, extra bookkeeping costs, state admin fees…it all starts to add up, racking up thousands in unexpected costs.

Your production company could swallow the overage, carving into your already slim margin. Or maybe you’ll swallow your pride and ask the network to cover the unexpected costs - never a pleasant conversation, and one that risks damaging reputations and relationships.

Sure, you might still receive a decent incentive. But the gap between expectations and reality leaves everyone upset and bitter about the whole process.

This doesn’t have to happen!

Production companies can avoid falling prey to the “incentives bait and switch” by ensuring they’re aware of and accounting for all costs associated with the incentive upfront.

We’ve listed our top six surprise costs associated with incentives that get productions into trouble - and cap them off with tips and tools that may help decrease costs while increasing your incentive.

Our Top 6 Hidden Incentives Costs, aka “We’ve gotta pay what to get our incentive?!”

Fortunately, most of the costs associated with an incentive are pretty predictable. They include:

Application & jurisdiction administrative fees

These fees will be spelled out in the jurisdiction’s guidelines, but they’re not always front-and-center, so they can be easy to overlook if it’s your first time applying to their program.

Illinois has a generous incentive, offering a 30% transferable tax credit on all qualified spending, including post—but they assess a fee equal to ”2.5% of credit amount eligible for non-resident wages, and an additional 0.25% of the total amount of the credit which is not calculated on non-resident wages.” And get this: the fee must be paid before the tax credit certificate is issued.

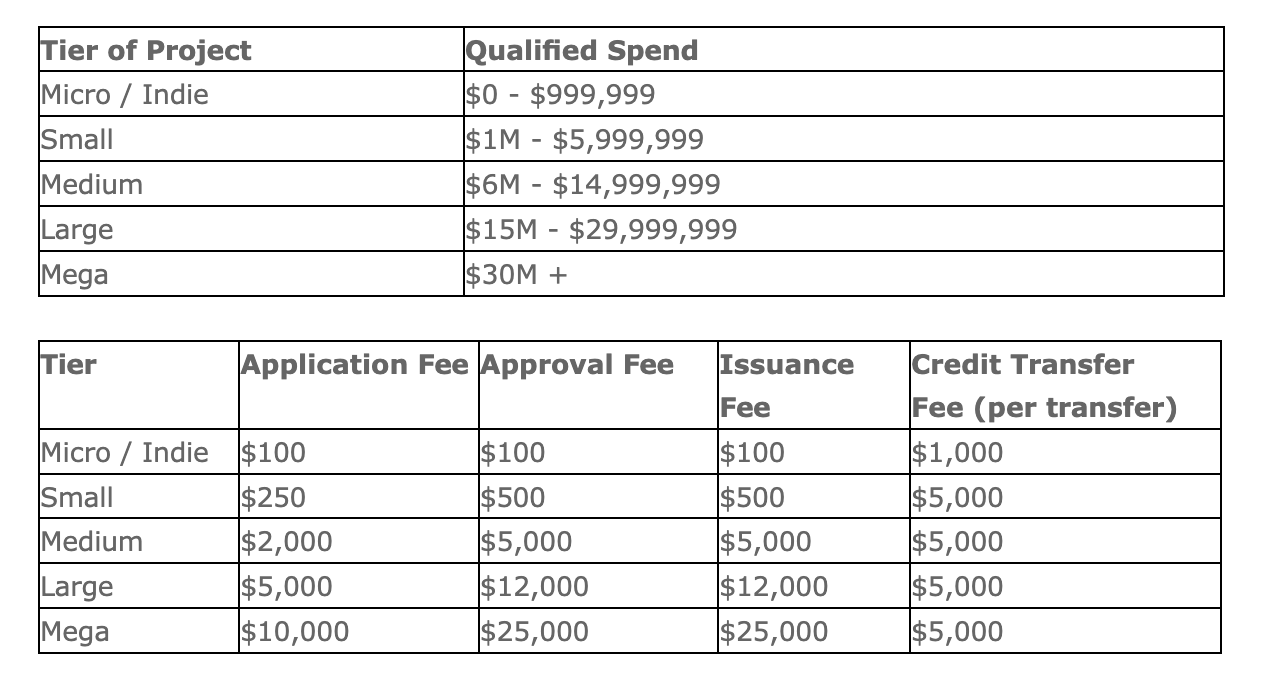

New Jersey’s incentive is also robust, with a transferable credit of up to 35% on qualified spend, but you’ll face a variety of fees, including an application fee, approval fee, issuance fee, and credit transfer fee. In total, they can shave anywhere from $1,300 - $65,000 off your incentive depending on your qualifying spend, as detailed in this table:

Louisiana’s generous credit of up to 40% of qualifying spend requires an application fee of 0.5% of the estimated tax credit (starting at $500, not to exceed $15,000).

Some incentive programs, like Hawaii’s, require companies to contribute a percentage of their qualifying spend to workforce development programs (in Hawaii’s case, the higher of 0.1% of the qualifying production spend or $1000). Hawaii also charges an administrative fee equal to 0.2% of the total credit.

Audit fees

Ah, the much-feared audit. Fees can range depending on the auditor, with some charging an hourly rate while others opt for a flat rate (we prefer the latter. Why? See this post about all things audit, featuring our friend David Brauer of Brauer & Co). Some jurisdictions use government auditors and typically have a set fee schedule for their services. Others may have a list of approved outside auditors.

Other jurisdictions, like Georgia, offer the choice of a state auditor or one from an approved list. The audit fee in Georgia varies depending on local production spend. If an “eligible auditor” is selected instead of one from the state, productions must still pay an administrative fee to “finalize” the audit:

Audit fees can also range dramatically depending on the thoroughness of the audit required by the jurisdiction. For instance, Texas and Illinois conduct thorough audits that require a review of all expense-related documentation. Hawaii, on the other hand, doesn’t require a CPA audit for credits under $1M (although they will conduct a quick internal audit, at no charge to the project). Don’t make the mistake of assuming the costs of an audit will be the same from one jurisdiction to another.

The “discount” on your transferable tax credit

We dug into the ins and outs of selling transferable tax credits with Chad Agena, Managing Director and Head of Tax Credit Brokerage at TPC, in this post. As Chad cautioned, don’t make the mistake of confusing your total transferable tax credit with your (lower) “net to production.”

In other words, if your company isn’t able to use the tax credit and plans to sell it, you won’t be able to recoup its entire value. Rather, when you sell it, you’ll do so at a discount - say, around 85-90% its total value, reaping less than its total value.

Jurisdictions might also charge a transfer fee. For instance, Louisiana offers to buy back such tax credits at 90 cents on the dollar and charges an additional 2% transfer fee. That $300K tax credit you’ve been counting on has suddenly dwindled to $264K…before factoring in other associated cost.

Business registration fees

Some jurisdictions require that out-of-state production companies form and register a local entity in order to receive the incentive. For instance, Louisiana requires that production companies be incorporated in Louisiana - a process that requires a state filing fee, registered agent service, annual filing fees, the paying of franchise taxes, and potential legal fees.

Some jurisdictions, like New Mexico or Hawaii, require that you file a tax return to receive their refundable credit, which may generate additional tax preparation costs.

Other jurisdictions may require additional registration and licensing fees, like Hawaii’s GET (general excise tax) license (granted, just $20).

Finally, when working in jurisdictions outside the US, production companies will often hire a local service provider to help with both production services and filing for the incentive. Such service providers sometimes require a percentage of the incentive as part of their compensation.

Promotional assets

Some jurisdictions might require that the production deliver promotional assets—everything from set photos to full-on social media campaigns involving talent. For example, the St. Pete/Clearwater, FL film commission offers an uplift in exchange for “extra marketing value,” including a “robust social media plan.”

This one may be easy to overlook, but creating those assets takes time. I’ve also seen productions mistakenly assume that talent will be eager to participate in promoting a location for free…until their agent calls, looking to score a piece of the action for their client.

Many jurisdictions require a logo in the credits (who hasn’t seen the “Georgia peach”?). Doing so generally doesn’t add to the budget, but production companies should make sure the network or streamer has agreed to include it to avoid jeopardizing the incentive down the road.

Bookkeeping fees

Wrangling all the paperwork required to file for an incentive takes time. Ensure you’re aware of the specific reporting requirements for your jurisdiction and that you’re properly budgeting for the additional production management/accounting labor required to manage the process. This, too, may vary depending on the jurisdiction’s reporting requirements.

How can you avoid the incentives bait-and-switch trap?

Three words: Plan, plan, plan.

Production companies:

Do your research. Dig into all the jurisdiction’s rules to ensure you’re account for all relevant administrative fees. Realistically plan for extra bookkeeping and audit expenses, as well as that transferable tax credit discount.

Pay attention to any caps the jurisdiction might impose on line items like above-the-line labor, airfares, and hotel costs so you don’t overestimate the incentive you’ll receive.

Keep detailed records. The better your records, the smoother the audit, the less time required and hours billed. Where relevant, talk to your auditor and the broker of any transferable credit ahead of time. They can help you avoid common mistakes and provide more accurate estimates of costs for their services, as well as the discount you should plan on for your transferable credit.

When filming in a new location, don’t assume that you can simply carry over costs like audit fees, accounting costs, and administrative fees from one jurisdiction to another. As we’ve seen, costs can vary wildly from one to the other.

Networks/Studios/Streamers:

Dissect any claims a production company makes about the amount of incentive they’ll receive. Are they including administrative fees? Audit fees? Have they properly accounted for extra bookkeeping and accounting costs? Caps?

This more thorough analysis takes time, but it could save you tens of thousands in unexpected costs in the end. In some rare cases, you might even find that applying for the incentive is more trouble than it’s worth.

Film commissions:

Be as transparent as possible about any administrative fees associated with the incentive. An easy-to-read table like New Jersey’s (above) will make it easier for producers to determine if your incentive is right for them, before they dig into the finer details. It’ll probably save you lots of time otherwise spent answering lots of questions, too!

Tools to help avoid the unexpected

Tech to the rescue! New tools may help reduce the costs of managing your incentives and increase the amount you receive.

Our favorites include:

Production accounting and payroll company Greenslate offers a variety of tools to help you estimate, track, and monetize your incentive, including a dashboard that tracks your incentives application status across multiple projects. Greenslate takes on all post-production accounting responsibilities, including coordinating with state agencies, auditors, and brokers. They boast a 99.5% accuracy rate when comparing their incentive estimate against the actual amount clients have received, which helps prevent any nasty surprises.

Incentiviiz’s incentives management platform works with your in-house production accounting team, boasting tools to help research incentives, compare estimates across multiple jurisdictions, and find local service providers. It also works with your existing file management system to import, identify, track, and manage qualifying expenses. Some users have reported boosting their incentives payout by as much as 6-10% by using the platform to uncover qualifying expenses they otherwise might have missed. At that rate, it basically pays for itself.

Have you used Greenslate or Incentiviiz? Let us know your thoughts - and tell them you read about them in this newsletter.

Production Companies: Budgets have never been tighter, or greenlights harder to come by, making incentives more important than ever. Still, the process isn’t always easy.

Share your incentives, headaches, questions, and quandaries with us and we might just cover them - along with advice from the experts - in an upcoming newsletter.

Film commissions: Need help luring productions? Contact us to brag about your incentive in this newsletter!

Drop me a line at carrie@carrieregan.com.